If you own a home, you want to retain or increase its value. You might want to do this because you plan to sell in the future, you like DIY and home improvements, or you need your home to function better than it already does.

While most homeowners focus on what they can do to increase a property’s value, they often ignore things that can bring down the value of a house. Usually, it can be a case of what you need to maintain or repair, rather than what you can add.

We’re going to show you some of the things that can devalue your home, and show you how to make the necessary changes so you can maintain or increase your home’s value.

What Brings Down the Value of a House?

1. Unfashionable Furnishings

We’ve all got our tastes, but let’s face it, some people’s taste is ‘unique’. Now, there’s such a thing as timeless design, and it can be achieved with some hard work and an eye for classic style, but most people don’t have that eye.

Also, it’s in the interest of the home improvement industry to push trends and fads because they make money from them. Then they go off-trend, and the cycle continues.

Also, there are people that buy once and don’t decorate again for decades. If your design is timeless, you have nothing to worry about. But if you want to maintain or increase the value of your house, you have to maintain and improve your home.

For example, if you decorated your kitchen in the early 00s and it looks like it was decorated in the early 00s, there’s a good chance it’ll affect your house price. Similarly, if you’re too niche or don’t get the most out the room, someone will have to re-do it.

How to solve the problem:

- Assess the damage, figure out how many rooms need to be redecorated or renovated. You don’t have to do everything at once; you can do one room at a time.

- Start looking at decor and furniture you like, so you can get an idea of how much it will cost to renovate the room.

- Get quotes for installation, for example, if you order a kitchen you may get free installation, whereas you might need a painter and decorator if you have wallpaper to paste.

- If you need to, you could get some help from an interior designer.

2. Japanese Knotweed

Japanese Knotweed was imported into the UK in the 1850s and was favoured by gardeners because it resembled bamboo and grew everywhere. Nowadays, Japanese Knotweed causes various problems for UK homeowners.

Japanese Knotweed can grow up to 10cm in one day, and its aggressive growth means it can target weak structures in buildings, causing structural damage as the weed tries to grow through them. Its roots can be as much as 14 feet deep, and it can lay dormant for up to 20 years.

Local authorities often refuse planning permission on infested sites, and mortgage lenders may not lend on properties that are affected by it. In this video, The BBC explore how a family lost £250,000 on the value of their home.

How to solve the problem:

- Cut the canes so they can’t regrow.

- Apply glyphosate weed killer.

- Wait seven days and dig out the weed with a pitchfork.

- Mow the plants down every week (if they’re on your lawn).

- Apply glyphosate twice per year.

- Contact a professional if the above doesn’t work.

3. Structural Damage

You may notice little things that appear over time, such as a missing roof tile or a crack in the foundation of your home.

While it can be tempting to ignore these problems, it’s always better to deal with them straight away because one problem can often lead to another problem, which is likely to be more expensive.

Estate agents will include these factors in their official price and will relay any information back to a buyer.

There are many signs of structural damage, which can include:

- Termites

- Sagging or leaking roof

- Wall and ceiling cracks

- Uneven floors

- Damp subfloors

- Timber rot

- Crumbling concrete

- Ill-fitting doors and windows

- Exposed gaps between walls

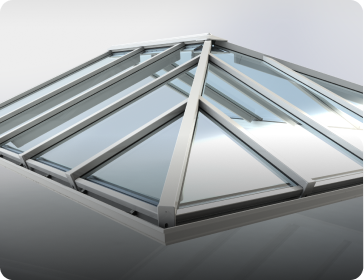

Also, don’t ignore your outbuildings such as conservatories, extensions and orangeries. Any structural damage could decrease the value of your home.

How to solve the problem:

With such a range of problems, there are a range of causes and solutions, so it’s better to get a professional in so they can diagnose the issue and resolve it accordingly.

4. Pets

Pets around the house can reduce home value by up to 10%! Now, nobody is saying you shouldn’t keep pets, but you have to be mindful of what pets you keep and how you keep them.

While dogs are cute and full of boundless positive energy, they can also cause damage from scratching, biting and walking muddy paw prints all over your floor.

However, pet odour is thought to be the biggest deterrent for the person valuing your home. Odours can take some vigorous cleaning which can be costly depending on the severity of the smell; you may even require new upholstery and furniture. We aren’t suggesting you remove your pets, but be aware of the damage and smell they can cause.

How to solve the problem:

If you’re thinking of getting your house valued, ask the opinion of a trusted friend (preferably one that’s not afraid to be honest and doesn’t own any pets). Ask them to walk around your home and see if they can smell any odours or spot too many pet-related items around the house.

5. Issues With the Area

The area you live in will affect the price of your house regardless of its features or what you think it’s worth. You may have a five-bedroom home, but if the area isn’t desirable, you’ll lose some of the value of your property.

Here are a few things that can affect house prices:

- Buyer demographics – if the people that buy in your area are mainly commuting working professionals and you have a four-bedroom house, you aren’t appealing to that target demographic.

- Housing surplus – if you own a four-bedroom house and a house builder decides to build another 50 four-bedrooms houses on the land next to you, you face more competition.

- Closure of facilities – public services, employment, amenities; if any of these services close, it could impact the value of your house as they’re often appealing to buyers.

- Low school ratings – buyers pay to live in areas with good schools because they want their children to have access to the best education. If schools are poor in the area, this could affect the price of your house.

- Environmental pollution – while this wasn’t a consideration until recent years, if you live near a factory or a polluted area your house price could be affected.

- Noise pollution – motorways and train lines are noisy places, and people often want peace when they’re at home. If there’s a new or existing road or train line near your property, it will affect the value of your home.

How to solve the problem:

Unfortunately, many of these problems are out of your control. While you could be involved in community discussions in your area, the outcome isn’t always what you desire, and even if it is, the process is often a long one.

6. Economic Factors

The banking crisis affected the UK housing market badly, and it still hasn’t recovered. Many homeowners were left out of pocket or with mortgages they could no longer afford; you may have been one of those people.

The housing market works on supply and demand, and if there’s an economic downfall, there isn’t a demand for people to buy houses. And if people aren’t buying homes, the value of your home could decrease.

Interest rates also affect the value of your house, for example, if The Bank of England raises the base rate, bank interest rates usually rise, which means your mortgage payments go up.

Rising payments mean people have to seek out cheaper properties, and if the demand for buying is low, the value of a home can plummet. There’s currently uncertainty of how Brexit will affect the base rate, which is leaving many homeowners and first-time buyers concerned.

How to solve the problem:

There’s little you can do to prevent economic downturn, but you can make sure you’re on the best mortgage deal to avoid any damaging interest rates.

Are You Getting the Most Value From Your Home?

If you aren’t paying attention to any of the above and you think your house price may be decreasing, you need to take action.